Company grew over 460% in 2022 as dealers seek new solutions

WarrCloud, a first-of-its-kind provider of technology-enabled auto warranty processing services, announced today that it has received a growth equity investment led by Argentum with participation from existing investors FM Capital and Automotive Ventures.

Warranty service work represents a growing percentage of automotive dealerships’ gross profits, but today, most warranty claims are processed through highly manual, error-prone, and expensive methods. To compound the issue, there is an increasing shortage of qualified warranty processors in the market as experienced workers retire and are less likely to be replaced by younger workers interested in other positions.

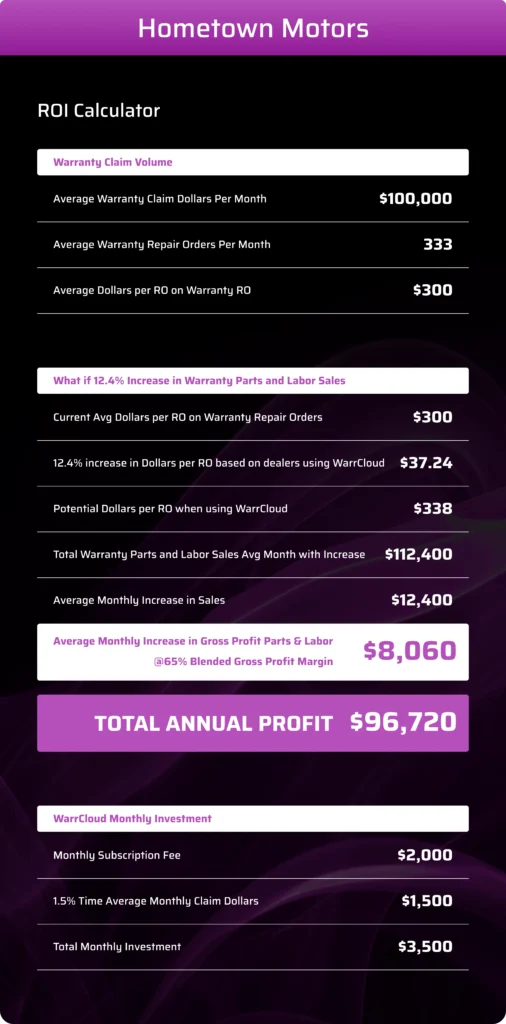

WarrCloud’s innovative technology streamlines and automates the warranty claim creation and submission process, thereby decreasing manual tasks, reducing errors, and accelerating cash collections by dealers. Across its dealership customer base, WarrCloud has been shown to decrease warranty processing times by 5x, increase warranty revenue over 10%, reduce processing costs by up to 60%, and improve compliance with OEM guidelines to improve dealer ratings and reduce costly audits.

“The automotive industry is undergoing tremendous change, with warranty the fastest growing component of the dealer’s service business. Dealers need new technology services to capitalize on these changes to drive top and bottom-line growth,” said Jim Roche, Founder and CEO of WarrCloud. “We are excited to partner with Argentum given their prior experience investing within automotive and other transportation verticals and track record of successfully scaling tech-enabled businesses like ours.”

The investment will further accelerate WarrCloud’s rapid growth by supporting product development, sales & marketing, and customer service capabilities. The funding also comes at an important inflection point in the company’s growth trajectory. In January, WarrCloud added President & Chief Revenue Officer Corey Roberts to the team; he joins WarrCloud with 27 years of automotive experience having led GTM functions at Snap-On Business Solutions, Xtime, and MyKaarma. In addition, WarrCloud will soon release its latest software product, CHIRP, which automates the process of collecting the documentation needed for warranty reimbursement. CHIRP significantly reduces the amount of time service personnel spend on supporting documentation, both increasing efficiency and customer satisfaction.

“WarrCloud provides much-needed automation and efficiency to a market lacking technology solutions and suffering from worker shortages. The company is clearly tapping into an important need, as evidenced by its rapid growth over the past few years. We look forward to supporting Jim and his team as they continue to grow the company,” said Sohum Doshi, Principal at Argentum, who will join WarrCloud’s Board of Directors in connection with the investment.

“As the first-to-market with a solution that automates critical back office processes, reducing costs and increasing revenue, WarrCloud is an indispensable partner to auto dealerships that are facing margin pressures and increasingly relying on services revenue. We are excited to partner with Jim and the WarrCloud team and to leverage Argentum’s successful record of investing in tech-enabled businesses that have pursued similar strategies,” added Daniel Raynor, Managing Partner at Argentum.

About Argentum

Argentum is a New York-based growth equity firm that helps scale bootstrapped B2B software, technology-enabled and business services companies. The firm invests in companies with revenues of $5 million to $25 million, providing capital to accelerate growth, fund acquisitions and / or generate shareholder liquidity. Over its 30-year history, Argentum has invested in nearly 100 companies, supported more than 200 add-on acquisitions, and been recognized on Inc.’s list of Founder-Friendly Investors for multiple years. Argentum fills the growing gap between early-stage venture capital investors and later stage growth equity firms by targeting bootstrapped companies seeking $5 million to $15 million of equity capital. To learn more, visit: https://argentumgroup.com/